Reading the small print may be tedious but asking these three questions about your indemnity product is crucial.

1. Contractual insurance policy or discretionary cover?

Insurance-based indemnity operates on the same basis as other forms of insurance. The policy wording defines what is covered by this legally enforceable agreement and if you are declined cover, you can seek arbitration from the Financial Ombudsman Service. That same legal protection does not exist with discretionary cover. The organisation can exercise its absolute discretion not to assist you, even if you are in the right subscription category, have paid the correct fees and the matter is within the scope of cover – and there is no independent source of adjudication. Whilst it rarely happens, as a mutual fund, a refusal to assist an individual member can be argued to be justified on the basis that incurring the costs of the case would not be in the interests of other members.

The flip side of the certainty of contractual insurance may be its lack of discretion in dealing flexibly with any claims at the fringes or beyond the scope of the policy, that a discretionary approach might encompass. But the reality is that nobody knows for sure whether or not contractual insurance policies have given the insured dentist the benefit of the doubt in individual cases and if so, how often.

2. Occurrence-based or claims-made?

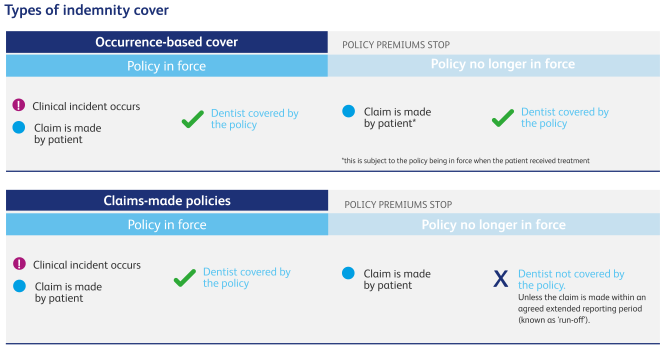

With occurrence-based cover, as long as you are paying the right subscription rate at the time the incident occurred that later gave rise to a claim, you will be covered in perpetuity. This means that if you did something negligent but retired the next day and stopped your payments, even if the complaint and legal claim is made against you three years later, you will be covered.

Claims-made is different. In the case above, if you do something negligent and then retire the next day, you will need to have 'run-off' arrangements in place to cover any claims that are made after you stop paying the policy premiums. These run-off arrangements are sometimes built into the policy, but in other cases require additional payments to be made.

It is common for complaints and allegations of negligence to arise a long time after the treatment was provided. Only about a quarter of the potential adverse incidents in a year will have given rise to a claim against the dentist within the first 12 months of the treatment being provided. With a claims-made policy you might need to continue paying a premium to the company long after you stopped working to ensure you would still be covered. There is no legal obligation to sell the 'run-off' cover once you leave the company - something to think about if you decide to take up a claims-made policy.

3. The support of a dentally qualified team?

Relationships really do matter and working with an indemnity provider who understands how you practice, the stresses and challenges you face, the complexity of the clinical care you provide and the environment in which it is delivered, is the first step to having an empathetic and supportive relationship.

Read Len’s full article in the BDJ (Member log-in required)

Len is the BDA’s senior dento-legal advisor, a general dental practitioner, foundation trainer and practice owner testing the NHS prototypes. He has 21 years’ experience as a dento-legal advisor supporting dentists with complaints, clinical and regulatory issues, and clinical negligence claims.